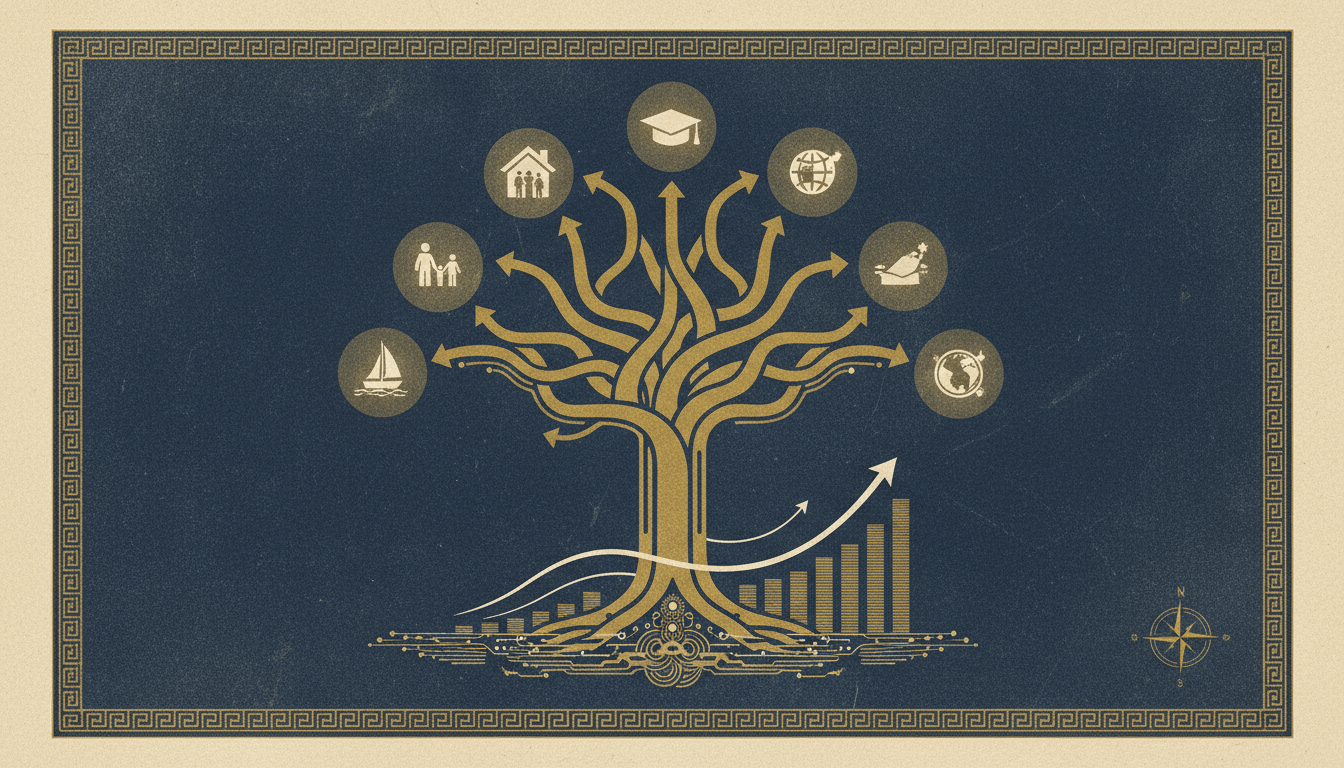

The integration of artificial intelligence in financial advisory services marks a pivotal shift in wealth management, offering unprecedented efficiency and personalization. Mezzi AI Financial Advisor stands at the forefront of this transformation, leveraging machine learning algorithms to deliver comprehensive financial planning at a fraction of traditional costs. With an annual subscription of $199, Mezzi provides advanced features such as account aggregation, real-time portfolio analysis, and dynamic tax strategy optimization. This platform is specifically designed for self-directed investors who value data-driven decision-making and seek to maximize returns while minimizing expenses. As financial technology evolves, Mezzi exemplifies how AI can democratize access to sophisticated advisory services, challenging conventional models with its scalable, technology-driven approach.

Core Financial Planning Capabilities

Pros

- Holistic account aggregation across banking, investment, and retirement accounts

- AI-driven asset allocation based on risk tolerance and financial goals

- Dynamic rebalancing algorithms that respond to market fluctuations

- Personalized savings rate recommendations with projected growth scenarios

Cons

- Limited human advisor interaction for complex estate planning needs

- May not fully accommodate highly specialized investment vehicles like derivatives

- Dependent on accurate user-input data for optimal performance

Specifications

Tax Optimization and Cost Management

Pros

- Automated tax-loss harvesting identifying opportunities to offset gains

- Strategic asset location advice to minimize tax liabilities across accounts

- Expense ratio analysis and fund replacement suggestions saving 0.25-0.75% annually

- Retirement account contribution optimization based on marginal tax rates

Cons

- Advanced tax strategies may require supplemental CPA consultation for complex situations

- International tax implications not fully addressed in current version

- State-specific tax nuances sometimes require manual overrides

Specifications

Comparison Table

| Feature | Mezzi AI | Traditional Advisors | Robo-Advisors |

|---|---|---|---|

| Annual Cost | $199 | $2,000-$5,000 (1% AUM) | $100-$300 |

| Tax Optimization | Advanced AI-driven strategies | Manual analysis | Basic tax-loss harvesting |

| Personalization | Machine learning-based recommendations | Human-curated plans | Questionnaire-based allocation |

| Account Aggregation | Real-time multi-institution sync | Limited integration | Partner institutions only |

| Investment Minimum | $0 | $100,000+ | $500-$5,000 |

| Human Support | Limited to complex cases | Dedicated advisor | Email support only |

Verdict

Mezzi AI Financial Advisor represents a significant advancement in accessible, technology-driven financial planning. Its $199 annual fee provides substantial value compared to traditional advisors charging 1% of assets under management, particularly for investors with portfolios under $500,000. The platform excels in delivering sophisticated tax strategies and real-time insights through its AI algorithms, though it may not fully replace human advisors for complex estate planning or highly specialized investment needs. For self-directed, tech-savvy investors seeking cost-effective, data-driven financial guidance, Mezzi offers a compelling solution that balances advanced capabilities with affordability. As AI continues to evolve, platforms like Mezzi are poised to reshape the financial advisory landscape, making professional-grade financial management accessible to a broader demographic.

Tags

Related Tools

Schwab Intelligent Portfolios: Comprehensive Analysis of the Zero-Fee Robo-Advisor Platform

Schwab Intelligent Portfolios, Charles Schwab's automated investing solution, offers zero management fees and diversifie...

SigFig Robo-Advisor: In-Depth Analysis of Features, Fees, and Performance

SigFig offers an accessible robo-advisor with a competitive fee structure, featuring no management fees for accounts und...

Magnifi AI Research Platform: Revolutionizing Investment Analysis with Artificial Intelligence

Magnifi AI Research Platform is a cutting-edge AI-powered tool transforming investment research for individual investors...

Robo-Advisor Market Trends: AI-Driven Evolution in Financial Advisory

The robo-advisory market is projected to reach $5-7 trillion by 2025, evolving from basic portfolio management to compre...

Betterment Robo-Advisor: Comprehensive Analysis of Automated Investment Platform

Betterment, established in 2008, revolutionized financial advisory with its goal-based robo-advisor platform. It employs...

Wealthfront: Goal-Based AI Financial Planning Platform Analysis

Wealthfront stands as a premier digital investment platform leveraging artificial intelligence to deliver sophisticated ...