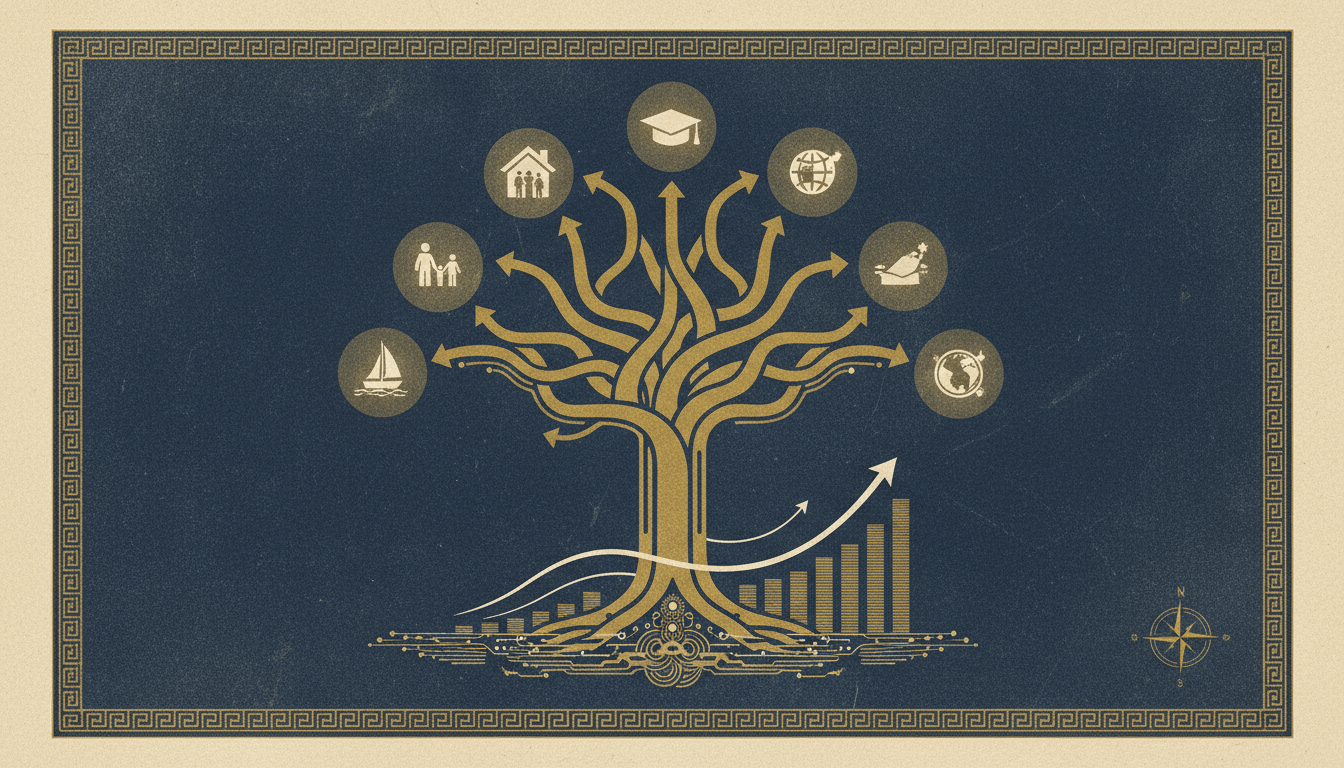

Betterment stands as a pioneering force in the robo-advisory space, founded in 2008 to democratize access to sophisticated financial planning. By leveraging advanced algorithms and a goal-oriented framework, it enables users to define and pursue specific financial objectives such as retirement savings, home purchases, or education funding. The platform's core innovation lies in its automated, data-driven approach, which minimizes human bias while maximizing efficiency through features like tax-loss harvesting and fractional share investing. With management fees between 0.25% and 0.65% and no minimum investment barrier, Betterment appeals to a broad audience, from novice investors to those seeking a hybrid model with human advisor support. Its integration of AI with traditional financial principles positions it as a leader in the evolving landscape of digital wealth management.

Goal-Based Investing Framework

Pros

- Personalized strategy alignment with user-defined objectives

- Automated rebalancing to maintain target allocations

- Enhanced user engagement through clear progress tracking

Cons

- Limited flexibility for highly speculative investments

- May not cater to complex, multi-generational wealth strategies

Specifications

Automated Tax-Loss Harvesting

Pros

- Reduces tax liability by offsetting gains with losses

- Operates continuously without user intervention

- Increases after-tax returns by an estimated 0.5-1.0% annually

Cons

- Effectiveness varies with market volatility and account size

- Not available for all account types (e.g., IRAs)

Specifications

Hybrid Advisory Model

Pros

- Combines algorithmic efficiency with human expertise

- Access to certified financial planners for complex queries

- Seamless integration for comprehensive financial planning

Cons

- Higher fees for advisor access (up to 0.65% management fee)

- Limited to scheduled consultations rather than constant availability

Specifications

Comparison Table

| Feature | Betterment | Industry Average |

|---|---|---|

| Management Fee | 0.25-0.65% | 0.30-0.80% |

| Minimum Investment | $0 | $500 |

| Tax-Loss Harvesting | Standard on taxable accounts | Often premium add-on |

| Fractional Shares | Supported | Limited availability |

| Human Advisor Access | Optional hybrid model | Rare or high-cost |

Verdict

Betterment excels as a top-tier robo-advisor by blending innovative technology with practical financial tools. Its goal-based approach, coupled with automated tax optimization and fractional investing, delivers significant value for cost-conscious investors. While the hybrid model adds flexibility, the core platform's $0 minimum and competitive fees make it accessible to all. However, investors with highly specialized needs may find its strategies somewhat restrictive. Overall, Betterment is a robust choice for those prioritizing automated, evidence-based wealth growth, supported by credible data from sources like NerdWallet and Finance Monthly.

Tags

Related Tools

Wealthfront: Goal-Based AI Financial Planning Platform Analysis

Wealthfront stands as a premier digital investment platform leveraging artificial intelligence to deliver sophisticated ...

eToro Social Trading Platform: Revolutionizing AI-Powered Investment Strategies

eToro stands as a pioneering social trading platform that integrates robo-advisory tools with community-driven investmen...

Acorns: A Comprehensive Analysis of the Micro-Investing AI Platform

Acorns revolutionizes personal finance through its micro-investing AI platform, targeting young and novice investors wit...

Wealthfront Robo-Advisor: Advanced AI-Driven Investment Management Platform

Wealthfront stands as a premier robo-advisor offering sophisticated investment management with a 0.25% annual advisory f...

Fidelity Go Robo-Advisor: Cost-Effective Automated Wealth Management

Fidelity Go is a robo-advisor offering free management for accounts under $25,000 and a low 0.35% annual fee for larger ...

AI-Powered Financial Planning Tool Integration: A Comprehensive Analysis

Modern robo-advisors are transforming into all-encompassing financial ecosystems by integrating services like investment...