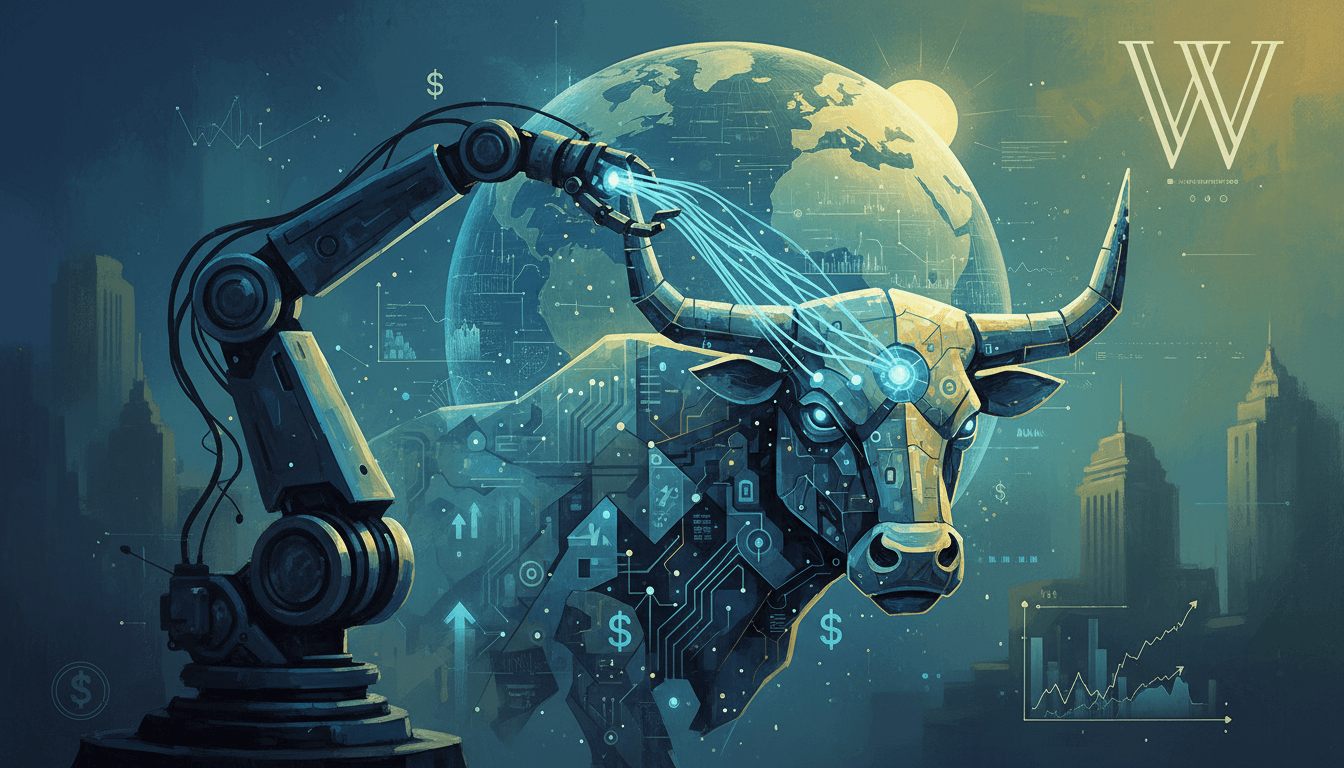

In the evolving landscape of financial technology, Wealthfront has emerged as a leader in AI-powered financial planning, managing an impressive $27 billion in assets. This platform integrates advanced algorithms to offer goal-based investment strategies, emphasizing tax efficiency and personalized advisory services. By harnessing predictive analytics, Wealthfront caters to investors focused on achieving specific financial milestones, from retirement savings to major purchases, providing a comprehensive suite of tools that adapt to individual risk tolerances and timelines. This analysis delves into its core features, advantages, and limitations within the competitive AI financial tools market.

Tax Optimization Strategies

Pros

- Automated tax-loss harvesting maximizes after-tax returns

- Direct indexing reduces capital gains taxes

- Continuous monitoring for tax-efficient rebalancing

- Integration with retirement accounts for holistic tax planning

Cons

- Limited effectiveness in tax-advantaged accounts

- May not suit investors with complex tax situations

- Requires minimum investment for full feature access

Specifications

AI-Driven Predictive Analytics

Pros

- Personalized financial roadmaps based on user data

- Real-time scenario modeling for goal achievement

- Debt management optimization algorithms

- Customized savings rate recommendations

Cons

- Relies on accurate user-input data for precision

- Limited human advisor intervention

- Predictive models may not account for black swan events

Specifications

Goal-Based Financial Planning

Pros

- Multi-goal tracking (e.g., retirement, education, home purchase)

- Dynamic asset allocation adjusts with timeline changes

- Automated portfolio rebalancing aligned to goals

- Educational resources for informed decision-making

Cons

- Less flexible for speculative or short-term trading

- Goal prioritization may require manual adjustments

- Platform primarily designed for long-term investors

Specifications

Comparison Table

| Feature | Wealthfront | Industry Average |

|---|---|---|

| Assets Under Management | $27 billion | $15 billion |

| Tax-Loss Harvesting | Full automation | Semi-automated |

| AI Predictive Models | Real-time analytics | Periodic updates |

| Goal Tracking Tools | Multi-goal support | Single-goal focus |

| Account Minimum | $500 | $1,000 |

Verdict

Wealthfront demonstrates exceptional prowess in AI-driven financial planning, particularly for goal-oriented investors prioritizing tax efficiency and long-term wealth accumulation. Its robust $27 billion AUM reflects trust and scalability, while features like automated tax optimization and predictive analytics offer tangible value. However, the platform is best suited for individuals with straightforward financial profiles; those with complex needs may require supplemental human advice. Overall, Wealthfront sets a high benchmark in the digital advisory space, blending technological innovation with practical financial management.

Tags

Related Tools

eToro Social Trading Platform: Revolutionizing AI-Powered Investment Strategies

eToro stands as a pioneering social trading platform that integrates robo-advisory tools with community-driven investmen...

Acorns: A Comprehensive Analysis of the Micro-Investing AI Platform

Acorns revolutionizes personal finance through its micro-investing AI platform, targeting young and novice investors wit...

Wealthfront Robo-Advisor: Advanced AI-Driven Investment Management Platform

Wealthfront stands as a premier robo-advisor offering sophisticated investment management with a 0.25% annual advisory f...

Fidelity Go Robo-Advisor: Cost-Effective Automated Wealth Management

Fidelity Go is a robo-advisor offering free management for accounts under $25,000 and a low 0.35% annual fee for larger ...

AI-Powered Financial Planning Tool Integration: A Comprehensive Analysis

Modern robo-advisors are transforming into all-encompassing financial ecosystems by integrating services like investment...

UBS Advice Advantage: A Comprehensive Analysis of the SigFig-Powered Robo-Advisor

UBS Advice Advantage is a robo-advisory platform that leverages SigFig's advanced algorithm to deliver digital investmen...