Sustainable investing has transcended its origins as a moral preference to become a cornerstone of modern wealth management. According to the Capgemini World Wealth Report 2023, environmental, social, and governance (ESG) factors are now integral to investment decisions, with global ESG-related assets expected to surge to $53 trillion by 2025. This growth reflects a profound shift in investor priorities, where 63% of high-net-worth individuals actively seek reliable ESG scores to guide their portfolios. As financial advisors worldwide adapt to this trend, understanding the drivers, metrics, and regional nuances of sustainable investing is essential for delivering value in an increasingly conscious market.

Understanding ESG Frameworks and Their Financial Impact

Environmental, social, and governance (ESG) frameworks provide a structured approach to evaluating companies based on non-financial criteria. The environmental component assesses factors like carbon emissions, resource conservation, and renewable energy adoption. Social criteria examine labor practices, community engagement, and diversity, while governance focuses on board accountability, transparency, and ethical leadership. The projection of ESG assets reaching $53 trillion by 2025 underscores their financial significance, as studies consistently show that companies with strong ESG profiles often outperform peers in risk-adjusted returns. For instance, firms prioritizing sustainability have demonstrated lower volatility and enhanced resilience during market downturns, making ESG integration a strategic imperative for wealth managers.

Investor Demand and the Critical Role of ESG Scoring

The demand for sustainable investing is largely driven by investor awareness and regulatory pressures. Data from the Capgemini report highlights that 63% of high-net-worth individuals now request reliable ESG scores, reflecting a desire for transparency and impact measurement. ESG scores, typically provided by rating agencies like MSCI or Sustainalytics, quantify a company's adherence to sustainability principles. These scores influence asset allocation, with portfolios increasingly tilting toward high-rated entities. For financial advisors, this means incorporating ESG data into client consultations, portfolio construction, and performance reporting. Tools such as ESG analytics platforms enable advisors to identify opportunities in sectors like clean technology and social equity, aligning investments with client values without compromising returns.

Regional Adoption: Europe, Asia, and the United States

Sustainable investing trends vary significantly across key regions. Europe leads in regulatory frameworks, with initiatives like the EU Sustainable Finance Disclosure Regulation (SFDR) mandating ESG disclosures for financial products. This has accelerated the growth of ESG-focused funds, particularly in renewable energy and green bonds. In Asia, countries like Japan and China are rapidly embracing ESG principles, driven by government policies and corporate reforms aimed at reducing environmental footprints. The United States, while initially slower, has seen a surge in ESG adoption due to investor activism and the rise of impact investing vehicles. Regional differences highlight the need for tailored advisory approaches, where advisors must navigate local regulations, cultural preferences, and market maturity to optimize sustainable portfolios.

Sectors Driving Sustainable Investment Growth

Renewable energy, social responsibility, and governance metrics are at the forefront of sustainable investing. The renewable energy sector, including solar, wind, and hydrogen technologies, has attracted substantial capital due to its alignment with global decarbonization goals. Socially responsible investments focus on companies promoting fair labor practices, health equity, and inclusive growth, while governance improvements target board diversity and anti-corruption measures. Financial advisors can leverage these sectors by identifying companies with verifiable ESG commitments, such as those reporting under the Global Reporting Initiative (GRI) or Task Force on Climate-related Financial Disclosures (TCFD). By emphasizing sectors with strong growth potential and positive impact, advisors can build diversified portfolios that meet both financial and ethical objectives.

Strategies for Financial Advisors in the ESG Era

To thrive in the era of sustainable investing, financial advisors must adopt proactive strategies. This includes continuous education on ESG trends, leveraging data analytics for portfolio optimization, and engaging clients in values-based discussions. Advisors should integrate ESG screening into due diligence processes, using tools like negative screening (excluding controversial industries) or positive screening (selecting leaders in sustainability). Additionally, collaboration with ESG research firms and participation in industry forums can enhance credibility. By aligning advice with the $53 trillion ESG asset projection and addressing the 63% demand for reliable scores, advisors can position themselves as trusted partners in navigating the complexities of sustainable wealth management.

Key Takeaways

- ESG-related assets are projected to reach $53 trillion globally by 2025, highlighting the scale of sustainable investing.

- 63% of high-net-worth individuals demand reliable ESG scores, making transparency a key advisory component.

- Europe, Asia, and the United States show distinct adoption patterns, requiring region-specific strategies.

- Renewable energy, social ethics, and governance are central sectors for ESG integration.

- Financial advisors must leverage data and client engagement to capitalize on this transformative trend.

Frequently Asked Questions

What is sustainable investing?

Sustainable investing involves incorporating environmental, social, and governance (ESG) factors into investment decisions to generate long-term financial returns while promoting positive societal impact.

Why are ESG scores important for investors?

ESG scores provide measurable insights into a company's sustainability practices, helping investors assess risks, opportunities, and alignment with personal values, as evidenced by 63% of high-net-worth individuals requesting them.

How can financial advisors integrate ESG into their practices?

Advisors can integrate ESG by using screening tools, staying updated on regulatory changes, and educating clients on the benefits of sustainable portfolios, particularly in high-growth areas like renewable energy.

Which regions are leading in sustainable investing?

Europe leads due to robust regulations, while Asia and the United States are rapidly catching up, driven by policy initiatives and investor demand across key markets.

Conclusion

The rise of sustainable investing marks a fundamental shift in wealth management, where ESG principles are no longer optional but essential for future-proofing portfolios. With assets poised to hit $53 trillion by 2025 and strong investor demand for transparency, financial advisors must embrace this change through education, innovation, and client-centric strategies. By leveraging regional insights and sector-specific opportunities, advisors can drive both financial success and positive impact, solidifying their role in a rapidly evolving financial landscape.

Tags

Related Articles

AI and Digital Transformation in Wealth Management: Reshaping Financial Advisory Services

Artificial Intelligence is fundamentally transforming wealth management, with 90% of financial advisors expressing posit...

Alternative Investments and Market Convergence: The New Wealth Management Paradigm

The wealth management sector is undergoing a transformative 'great convergence' where traditional and alternative asset ...

Client-Centric Digital Transformation: The Future of Wealth Management

Wealth management is undergoing a profound shift toward client-centric digital transformation, with over 70% of firms pr...

The Transformative Impact of Generative AI in Financial Services: Reshaping Wealth Management

Generative AI is revolutionizing financial services, with 90% of financial advisors expressing positive sentiment toward...

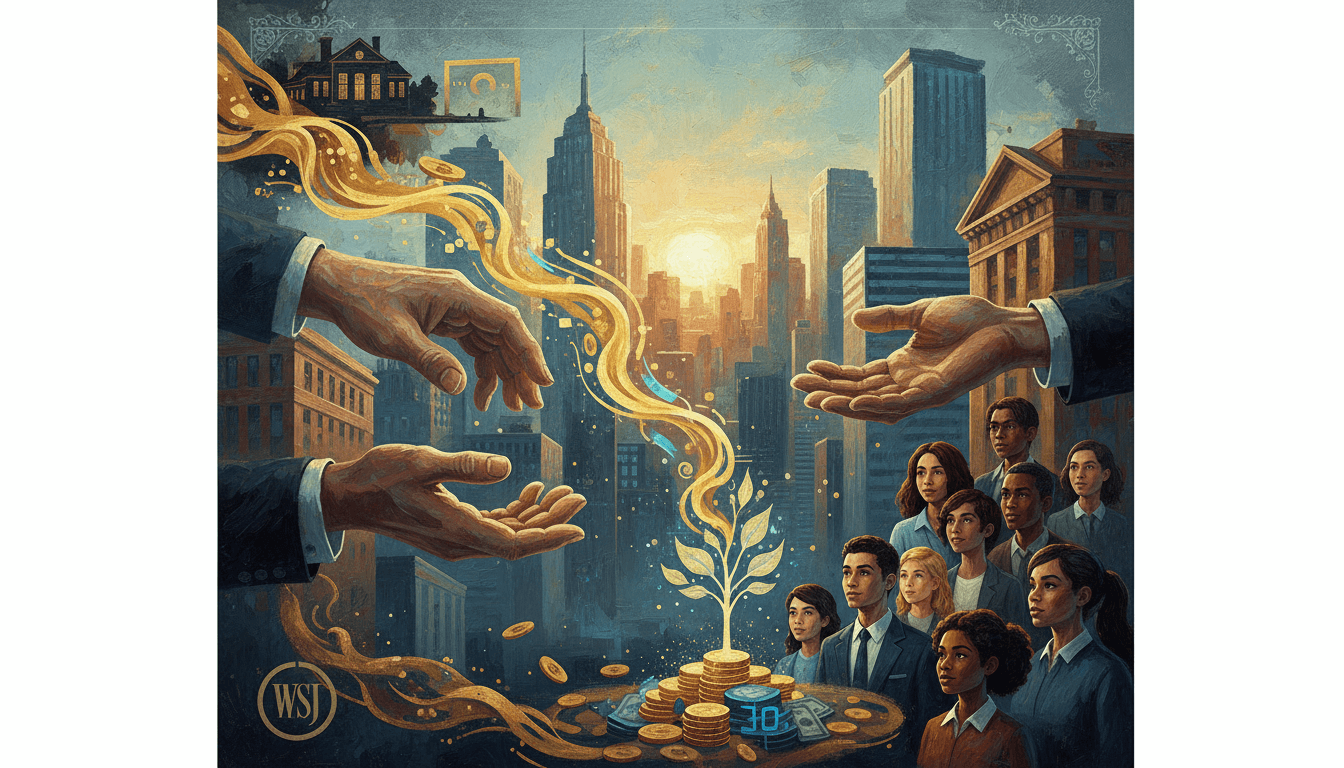

The Great Wealth Transfer: How Younger Generations Are Rewiring Investment Strategies

A monumental intergenerational wealth transfer is reshaping global finance, with over $68 trillion projected to pass to ...

Operational Resilience and Technological Adaptation in Wealth Management

Wealth management is undergoing a significant transformation, with 64% of European financial institutions prioritizing o...